The mandatory inclusion of mental health in health insurance plan has too many conditions to make any significant changes.

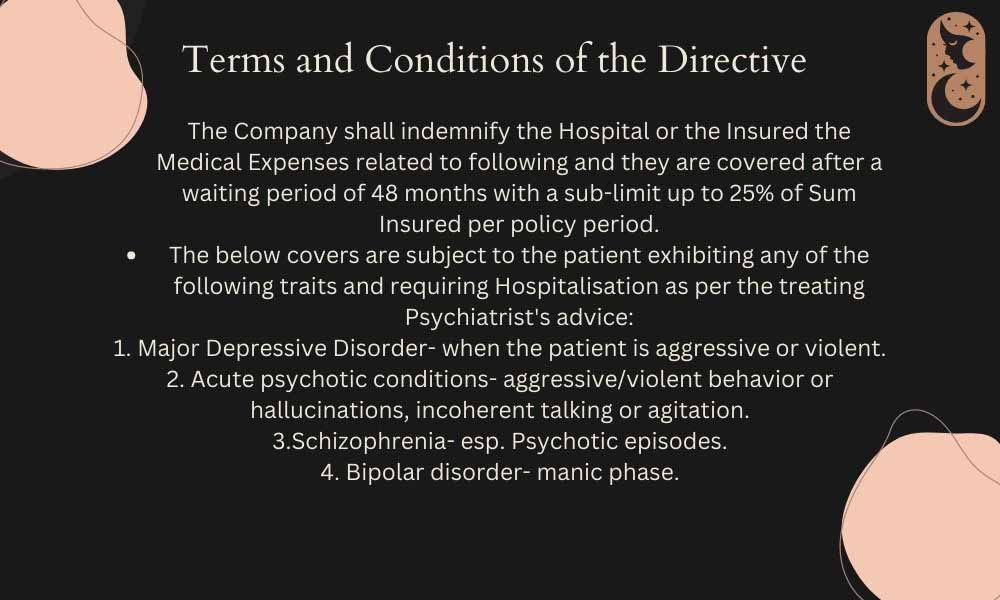

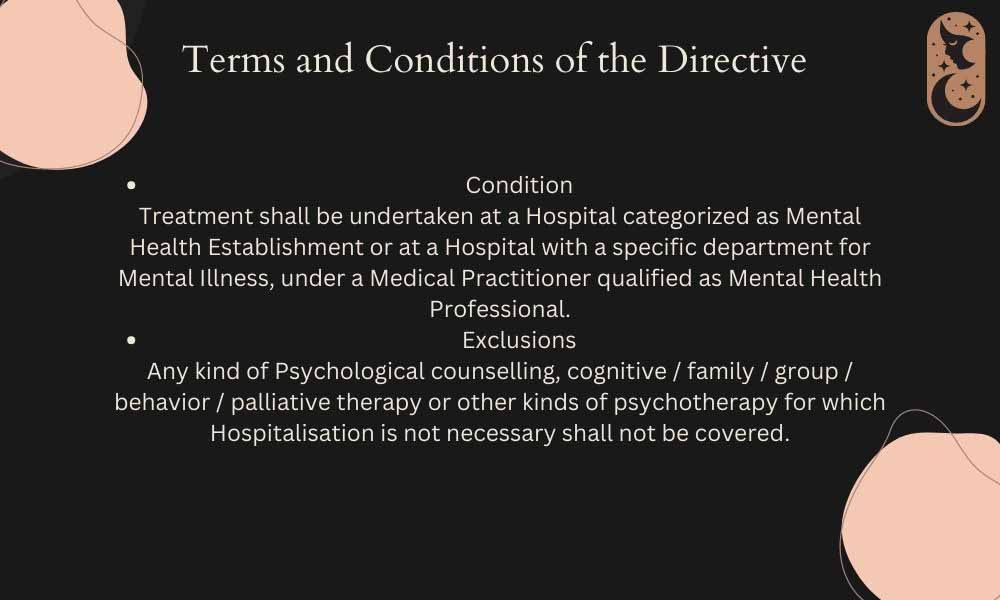

The Insurance Regulatory and Development Authority of India’s directive that makes it mandatory to include mental illnesses under health insurances has multiple clauses that exclude basic mental health expenses and problems. It covers

only four mental illnesses, with conditional situations.

The waiting period is 48 months, while the insured policy sum sub-limit for each policy period is 25 percent. Experts say this has been done in order to ensure a profitable business for insurance companies.

The four conditions mentioned are major depressive disorder (when the patient is aggressive/violent), acute psychotic conditions (aggressive/violent behaviour, hallucinations, incoherent talking or agitation), schizophrenia (especially, psychotic episodes), and bipolar disorder (manic episodes). Only hospitalisation for these conditions, under these issues directed by the patient’s psychiatrist would make the patient eligible for claiming insurance. Expenses incurred without hospitalization for these illnesses under these sub-conditions or other illness will not be covered. In addition, injuries sustained as a result of suicide attempts will not be covered. Experts say that the exclusion of the recurring mental health expenses and basic mental health problems makes the directive less helpful.

Dr. Chetan B, Associate Professor of Psychiatry at National Institute of Mental Health and Neurosciences (NIMHANS) said that the directive follows a business model, rather than a social welfare model. “Insurance has become a booming business. We have to take in consideration how premiums are calculated. It’s a distribution statistics – any calamity is distributed amongst everybody equally. Hundreds of people pay the premium, but not all of them claim it.” He added, “But for mental health problems, like diabetes and hypertension which are common, where everyone diagnosed will want to claim their premiums. So, insurance companies won’t make profit from it.” Dr. Chetan further said that since mental health illnesses are long-standing, need recurring treatment, and medications are expensive, insurance companies covering that would further lead to a loss-making business.

United Nations Convention for Persons with Disability (UNCRPD) in 2006 led to the Mental Healthcare Act, 2017 (Link not working). The UNCRPD and the Mental Healthcare Act of 2017 made it a right for an individual to seek help for mental illnesses and disabilities caused by it. The new laws that resulted from the UNCRPD were right-oriented, and the first notification issued to insurance companies to include mental illnesses was in 2018.

However, Dr. Chetan said the government’s social welfare model gets negated by the Nov. 03, directive’s business outlook. “India is trying to be a corporate and a welfare society at the same time, which is not possible. But we don’t have enough resources for a well-functioning social welfare state, while it is not right asking businesses not to do business. But they should not make money through health.” He added that there should be an ethical and moral concern in this regard which will happen only with time. Dr. Chetan concluded by saying that as awareness about mental health increases and mental health insurance becomes more mainstream, the government will amend and update the current mandate to be more inclusive. “Through negotiations, a balance will be reached. Five years ago, mental illness was not included at all, but now it is. Things will change.”

Sumitra (name changed), parent of a patient diagnosed with Boderline Personality Disorder said that the policy will be of very little help to them. “We have had to hospitalise my child only twice in the five years that the issue was diagnosed, and even so they were for attempted suicides, which are also not covered under this directive.”

Sumitra believes that if the policy covered hospitalisation for suicide attempts at least, it would have been of some help to her. “Even if it’s very extreme, hospitalisation would only be our last option and it very rarely crosses that limit. But the regular expenses of therapy and medication and treatment in general is where the large chunk of money goes because it’s not just expensive but goes on indefinitely sometimes. It would have been good to have some help in that effect,” she said.

Gopal Chatterjee, an agent for the Life Insurance Company (LIC) said that the directives are going to be updated and it is difficult to predict how many people will claim their premiums for mental health. “Mental health is still new and insurance for it even newer. People are unlikely to take premiums for mental health but since it will now already be included in health insurance plans, people might claim it. But it’s very new so it’s difficult to be sure,” he said.

A senior official in a leading government insurance company said that the policy, in terms of welfare, needs to expand. “There are a lot of factors like market audience, audience response and demand, and so on that needs to be considered. Now it’s just a sampling policy to increase awareness,” he said. The official added that in order for the policy to make a difference the coverage has to be expanded. “The waiting period is 48 months so from now we have to wait at least four years to understand the ways in which the government will update the directive.”

A September 2022 study by Deloitte states that around 15 percent of the global mental health burden comes from India. It further states that the treatment gap in India is large which is mainly caused due to stigma around mental health disorders in general. The study further notes that a NIMHANS survey found that around 80 percent of people with mental health disorders stopped receiving treatment as a result of stigma they received from it.