Non-Resident Indians (NRIs) across the globe are using cryptocurrencies for remittance to avoid expensive cross-border payment transfer charges. Recently, all of the major cryptocurrency exchanges have seen at least a 100 percent rise in trade and investment.

A World Bank committee has suggested the benefits of Central Bank Digital Currency (CBDC) in cross-border payments.

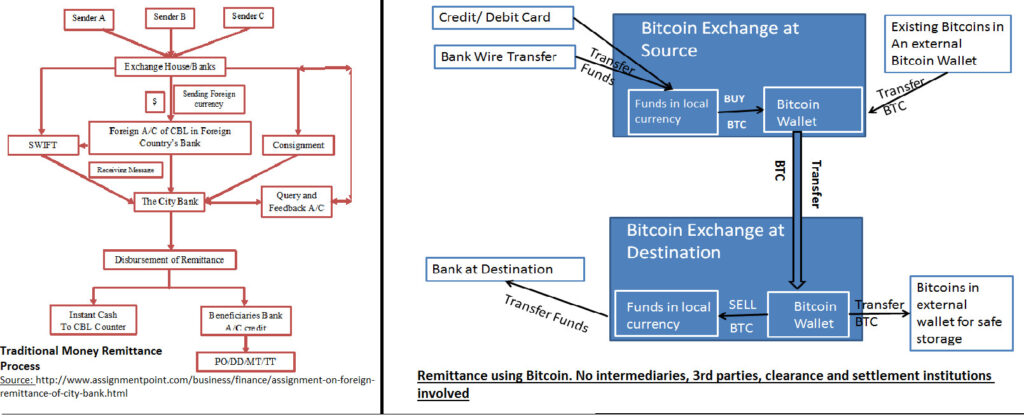

The process of sending money to India using cryptocurrency is a lot more efficient and faster than the traditional method of approaching cross-border money transferring agencies, and all transactions are accessible on the blockchain network from a regulatory standpoint.

A report by the World Bank on CBDC for cross border payments states remittances through crypto-assets is only expected to expand, as people use crypto assets because transferring smaller sums through traditional systems are costly.

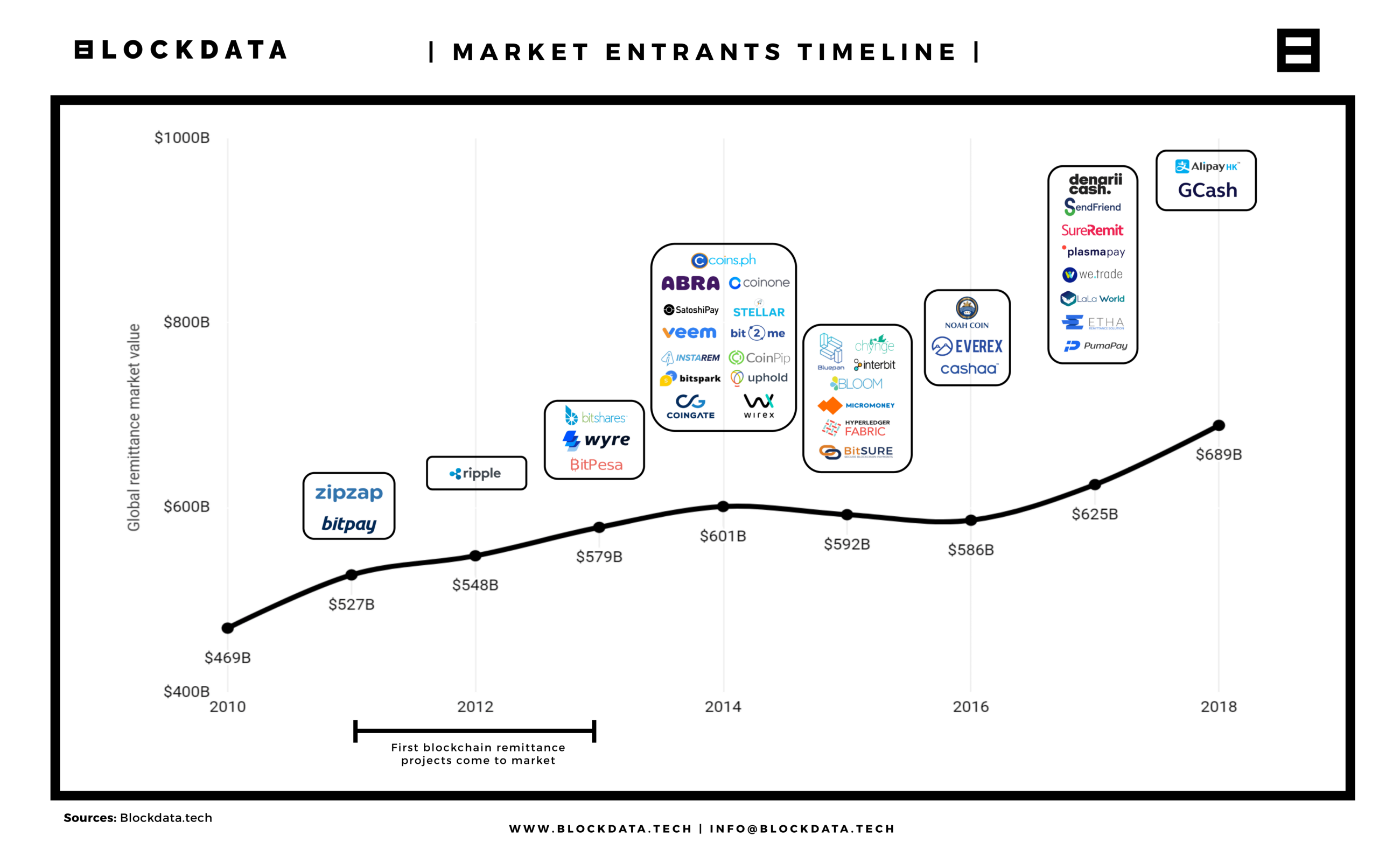

Also, several blockchain firms throughout the world, such as Satoshi Citadel in the Philippines have begun to offer services to make bitcoin transfers more user-friendly.

It is easy to remit money to India and anywhere in the world. Also people need to be literate about the method otherwise they may lose their money in transferring if they invest in fluctuating cryptocurrencies.

The majority of those wishing to send money are using less volatile crypto assets like Stablecoins. “When sending money, users want the value to stay the same and unaffected by market fluctuations. For such transactions, stable coins pegged to the US dollar are the ideal option. To make these transfers, most people prefer stable currencies like Tether (USDT) or USD Coin (USDC),” said Patel.

World Bank has found that depending on the destination country and the type of service utilised, a $200 transfer can involve typical costs ranging from 5% to 9.3%. In the third quarter of 2020, it was discovered that the global average cost of transferring $200 is 6.8 percent.

A World Bank’ report shows that India has received $87 billion in remittances in 2021, which are mostly sent through banking or other financial channels.

After Western Union, across-border money transferring agency suspended operations for a period after the US withdrew from Afghanistan, cryptocurrency remittances became a lifeline for the people in Afghanistan. Also, in countries with high inflation like Lebanon, Turkey, and Venezuela, cryptocurrency is gaining popularity.

A major concern expressed by various countries is the use of cryptocurrency transactions for money laundering. Remitting cryptocurrency comes under trading as people transfer money into their crypto wallet and use it in other countries.