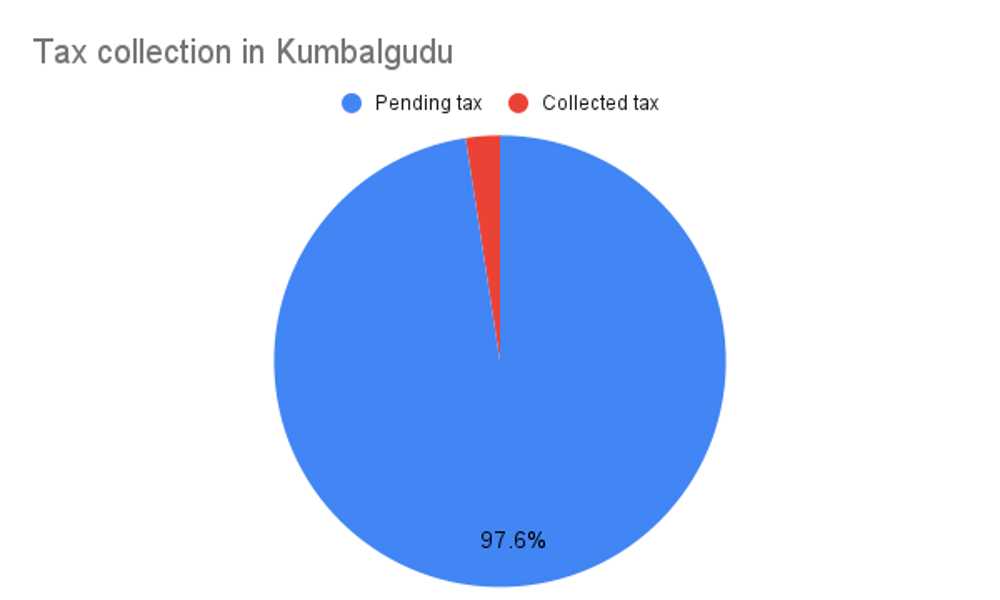

The Kumbalgodu Panchayat did not receive 97.54 percent of the property tax for 2021 – 21.

Kumbalgodu Panchayat collected property tax from 2.44 percent of tax payers in 2021 – 22. Out of Rs. 4.27 crores expected, the panchayat has received Rs. 10 lakh as property tax, said the Rural Development and Panchayat Raj Department data.

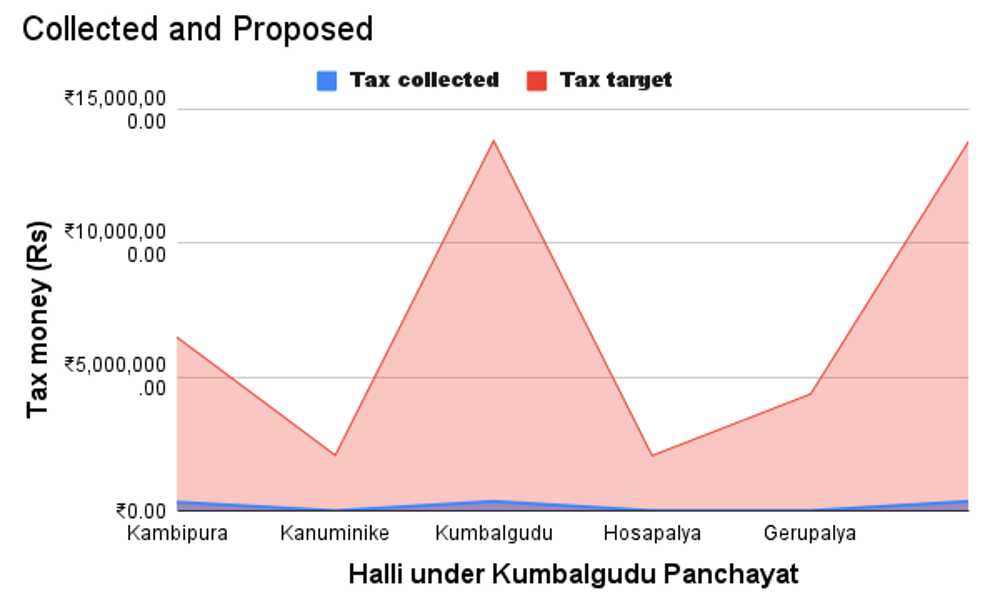

According to the data given in – Panchamitra, the Grama Panchayat Portal of Kumbalgodu Panchayat they should receive Rs. 4,26,59,717 from property tax payers in the six villages (Kambipura, Kanuminike, Kumbalgodu, Hosapalya, Gerupalya and Anchepaalya) under the panchayat in 2021 – 22. However, it has received Rs. 10,42,232 for the current financial year.

The panchayat increased the property tax rate in January 2021 based on the zones. Panchayat members said that because of this and to enable people to pay the tax, they extended the deadline from April to the end of June. However, their collection still fell short.

Rural Development Department data shows a deficit of Rs. 6,82,14,320 in the Kumbalgodu panchayat budget. However, since the panchayat manages its expenditure with the 14th Finance Commission grant, Legislative Commitment grant and Clean India Campaign grants along with the state and the central government grants, they don’t feel the pinch.

Manju. B.N, tax collector at Kumbalgodu Gram Panchayat said that there is no shortage of funds. He added that since most people pay their taxes voluntarily, he and his colleagues have gone to the village only once or twice to ask for the payment. He added that some people do not pay the taxes because the panchayat does not impose a penalty.

“The major reason behind the shortfall is that the elected members are not aware of their responsibilities of development that requires financial resources. The central government and the state government are giving grants and they do not bother to collect the revenue. Also, the elected panchayat members have close relationship with the local people. So, they are reluctant to collect the taxes,” said M. Devendra Babu, professor at Institute for Social and Economic Change.

Santhosh Kumar, a Chartered Accountant from the company ‘CA In Bangalore’ said, “There is no follow-up from the authority. Even if they do two visits, 50 percent of the amount will be collected. Secondly, most people are not aware that they have to pay property tax annually.” He added that in the case of willful defaulters, the panchayat ought to have exercised some stringent mechanism to collect the tax. “They are not being notified. A simple reminder should be sent to the people,” he said.

Lakshmiamma and Lakshmi Narasimma, shop owners in Kumbalgodu said that they don’t know there are property taxes that need to be paid. Arun, an auto-driver in Kumabalgodu said, “I pay the tax otherwise it gets piled up every year. There is no penalty for the defaulters and hence many people don’t pay. The panchayat officers have never come to ask for collection. I pay voluntarily.”

Karnataka Gram Swaraj and Panchayat Raj Act, 1993 said, “Recovery of taxes due to the Gram Panchayat excluding the arrears in sub-section (6), shall be primary obligation of the panchayats and where such recovery falls short of 80 percent of the tax recoverable, the panchayat shall, investigate the reason for such shortfall and take necessary action.” However, there is no acknowledgement from the authorities regarding this shortfall in property tax collection.

Babu said, “The state government is not ready for fiscal decentralization. The state government has to release the finances to the panchayat based on the State Finance Commission recommendations. The commission recommends that whatever the grant is, the panchayat have to match a portion of the grant. If the panchayat is unable to mobilise funds and match the grants, proportionately there will be a cut in the state government’s grant. But the state government does not insist on this.”