Statistics show, for every mobile banking transaction done by Indians in 2020, they have done two in 2021.

Salaries, rent, groceries, shagun, utilities, petrol charges, and investments for a layman. Procurement of raw materials, advertisement expenses, capital expenditure, IT maintenance services, and more for a business house. All these payments are done digitally, pan-India.

According to Reserve Bank of India (RBI) statistics, the volume of transactions through mobile banking has risen from 2,147.8 crore to 4,353.4 crore transactions – an increase of 102.7 percent.

Complementing the rise in the number of transactions, the amount transacted has also increased by 82 percent – from ₹75.45 lakh crore to ₹ 137.12 lakh crore.

Immediate Payment Service (IMPS), overseen by the National Payments Corporation of India (NPCI) is mostly accessed through mobile banking. It provides a robust and real-time fund transfer 24 X 7.

The RBI increased the limit for the amount per IMPS transaction from ₹ 2 lakh to ₹ 5 lakh in October 2021.

An increase of 21 percent was witnessed in the volume of transactions in the October – December quarter as compared to the July – September quarter of 2021, after the change in transaction limit.

Apoorva Bhatia, Business Development Lead at NPCI International, attributed the change in the limit as one of the main reasons for the rise in transactions. “The increase in the [transaction] limit of IMPS and with more banks being added to the service, will act as a catalyst to the growth of IMPS.”

“Due to the pandemic, people in the upper segment and middle segment are a little hesitant to handle cash,” said Meshach Manohar, Chief Business and Strategy Officer at Accupayd Tech Private Limited (a Fintech start-up).

Manohar further reasoned the increase in e-commerce transactions and the rise of e-payment applications such as Cred during lockdown and work-from-home for the increase in online payments.

Junofy Anto Rozarina, an economist said, “With the introduction of Jio [network] internet accessibility is growing faster in India, so I expect an increase in the next year as well.”

She also explained that banking applications have become more accessible than earlier. “I remember using banks [applications] in the past versus now and it is way more user friendly.”

But, due to a monetary cap on the amount that can be transacted through mobile banking, business houses or corporates prefer Real Time Gross Settlement (RTGS) or National Electronic Fund Transfer (NEFT).

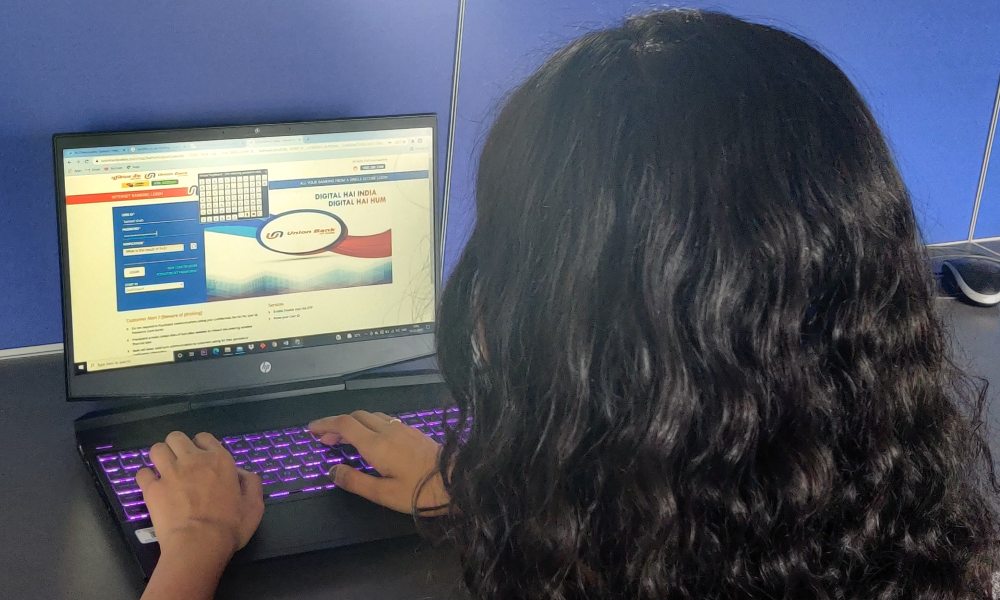

“There is a [monetary] limit in our bank – ₹ 2 lakh for mobile banking and ₹ 5 lakh for internet banking, but there are no limits for RTGS,” Komal Khalkho, Assistant Manager at Union Bank of India said.

He further explained that since businesses are required to make frequent transactions with higher amounts, they prefer RTGS.

The volume and amount of transactions through NEFT and RTGS have also gone up significantly.

NEFT has witnessed a 29 percent rise in the volume of transactions from 294.63 crore to 380 crore; a 16 percent rise in the amount transacted from ₹ 238.5 lakh crore to ₹ 276.8 lakh crore.

“All transactions are done online. Most of them are through NEFT.” Rajeev Nair, accounts and finance head at Absolute Sports Private Limited (SportsKeeda) said.

But the maximum amount is transacted through RTGS. It has shown an increase of ₹ 181.9 lakh crore (17 percent) from ₹ 1,053.2 lakh crore to ₹ 1,235 lakh crore. The volume of transactions through RTGS has also increased 36 percent in 2021.

Bhatia said, “RTGS was made available for the whole year – 24X 7 – since December 2020. This has increased [RTGS] transactions.” Earlier it was available only between 8 a.m. and 7 p.m.

However, certain businesses have to rely on traditional modes of payment such as cheques. For instance, Keshodwala Foods is an entity that deals in exports of fisheries.

“Most of the transactions are done through NEFT or RTGS. But we have a lot of transactions with fishermen. They rely on cheques and hence we make payment to them through cheques,” Abdul Kadir Sama, the accounts manager at the entity explained.

The digitization of transactions has also positively impacted the Indian economy.

“By reducing cash in circulation, transactions are recorded and it reduces illegal transactions,” Bhatia explained. She also said that the merchants record the payments and are bound to pay taxes to the government, thereby increasing their tax revenues.

The digitization of transactions has also resulted in the creation of new job opportunities. The fact that digitization will result in the lesser requirement of people is a myth.

“We need more employees since the workload keeps on increasing,” Khalkho said. “We try to provide more services to customers at their doorstep and this requires more people.”

Bhatia also had similar views. “The digital economy has a lot of potential to enhance job opportunities in new markets as well as increasing employment opportunities in some of the existing occupations in the government.”

Rozarina believes that such a trend is good for the economic growth of the country. “The GDP of a country is [depicts] basically how fast the money is moving in the country. A lot of people are making a lot of transactions. It means a lot of products are being sold or a lot of services are being performed. Which means that the GDP would be higher.”

The digitization of transactions has helped the start-ups with Application Programming Interface (API) banking. “The banks have realized that they are not nimble enough in the technology space. Hence, they are trying to promote start-ups through API banking. The start-ups will develop the things on their own and banks don’t have to do much. They can earn their share out of such API transactions,” Manohar explained.

While the transactions have increased during 2021, it will be worthwhile to see the trend in the current year. “I expect it [volume of transactions] to decrease. It will not stick to the current trend. 2022-23 will be a test for how the habits stick, which were created in 2021-22,” Manohar said.