Karnataka is the second state after Rajasthan, to introduce an insurance scheme for gig workers.

Prasad Kumar worked as a food delivery person in the city. One day when the restaurant delayed an order, he had to rush to complete his delivery on time, else he would lose his incentive. But he met with an accident on road and couldn’t deliver on time. Somehow, he managed to deliver the order, but the customer was rude. And, the food delivery platform fined him for late delivery.

He quit the job but had to foot the medical bills on his own. He was not aware of the Karnataka State Gig Workers Insurance Scheme, which he could have used to cover his medical expenses.

This is not an isolated incident. Most gig workers in the state are unaware of the scheme and have not registered because the labour department has no access to the data of gig workers as aggregators are not ready to share it. As of Jan. 2024, 1778 people have registered under the scheme. According to estimates, there are over two lakh gig workers in the state.

Raja, a delivery person with a food delivery aggregator, said that he does not know anything about the insurance scheme. He added that his friends are also unaware of the scheme

Anjan Prasad, who works as a delivery person with a logistics aggregator in the city said that he has not heard about the scheme before. “If such insurance schemes are available, it would be more helpful for delivery workers and make us more confident,” he added.

Shiva, another food delivery person also said that he is not aware of the new scheme by the state government

Aggregators are not ready to share the database of the workers as they claim that one worker could be enrolled in multiple platforms.

Tousif, an administrative staff at a logistics aggregator in the city said, “We cannot share the data of workers with the labour department as most of them are enrolled in multiple platforms. This can lead to multiple entries for the scheme.”

He added, “We are still working on a plan to address this issue. As of now, we are planning to encourage our workers to apply for the scheme on their individual capacity using their Aadhar card. This could ensure that only one entry per person is made.” However, the aggregator has not notified the workers and most of them are unaware.

Tousif said, “I know stories of workers who were not able to get medical care due to financial constraints. So, I believe that the government’s insurance scheme will definitely benefit the gig workers in the state who are not entitled to other incentives.”

Dr. S Sriranjani Mokshagundam, Professor of Management, BGS B-School, Bangalore said that lack of awareness, registration hurdles and information gap can be some of the reasons for the scheme not reaching all eligible workers. She said, “Gig workers who are new to the platform or working outside major cities, might be unaware of the scheme. The online registration process might pose challenges for some workers, especially those unfamiliar with technology or facing language barriers.” She also said, “The official website might not be easily accessible or comprehensive enough for all workers to understand the scheme’s intricacies and eligibility criteria.”

She added, “Some workers might be hesitant to trust government initiatives and may underestimate the importance of insurance or may prioritize immediate earnings over long-term benefits like insurance coverage.”

Masum, a delivery person with a food delivery aggregator, who has registered under the scheme said, “I came to know about the scheme through the aggregator I work for. I felt that an insurance scheme will always be an additional support for me.”

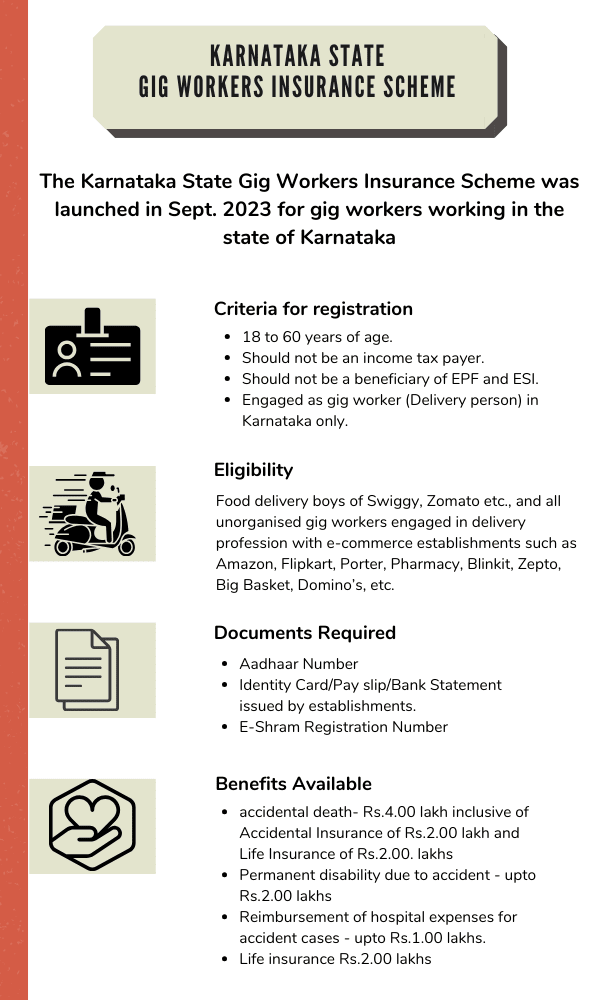

The Karnataka State Gig Workers Insurance Scheme was launched in Sept. 2023 with an insurance cover of Rs. 4 lakhs to each gig worker in Karnataka. According to the scheme, the beneficiary is eligible for Rs. 4 lakhs in case of accidental death, up to Rs. 2 lakhs in case of permanent disability due to accident, up to Rs. 1 lakh as reimbursement of hospital expenses for accident cases and a life insurance of Rs. 2 lakhs.

“Food delivery boys of Swiggy, Zomato etc., and all unorganised gig workers engaged in delivery profession with e-commerce establishments such as Amazon, Flipkart, Porter, Pharmacy, Blinkit, Zepto, Big Basket, Domino’s, etc.,” working in Karnataka are eligible to register under the scheme.

The scheme was a promise made in the Congress election manifesto during the 2023 Legislative Assembly elections and in the Chief Minister’s budget speech for the 2023-24 budget. According to the speech, the insurance scheme was introduced in order to provide social security to the gig workers in the unorganized sector who are employed as full time or part time delivery personnel in e-commerce companies.

Dr. Mokshagundam said that the scheme is a notable initiative that has the potential to significantly benefit the gig workers in the state. She noted that the financial security and insurance cover offered by the scheme can be “crucial for gig workers who often lack stable income and traditional employee benefits, especially in case of unfortunate events.”

Assistant Labour Commissioner, Meena Patil, said that the lower penetration of the scheme is because it is relatively new. “Workers do not catch the idea of an insurance scheme all of a sudden. The labour department is conducting camps for gig workers to make them aware of the scheme and get them enrolled,” she said.

The department is conducting meetings with aggregators and workers unions in the city to encourage workers to enrol in the scheme, she said. “Gig workers do not easily attend the camps as they are always busy and mobile,” she added.

The government has released Rs. 2 crores for the scheme and no accident claims have been made yet, she said.

Suman Das Mohapatra, a Working Committee Member of All India Gig Workers Union (AIGWU), from Bengaluru, said that the union was not invited for any meetings with the labour department. He said, “At the grassroot level, gig workers are not concerned about their social security. They are not aware of the insurance scheme or the online procedures to follow. The labour department should communicate the message to the workers and help them register under the scheme.”

He added that in a gig economy, workers are not permanent as they move in and out of their jobs. He also said that the government not having the list of gig workers in the state is a challenge.

He also said that the government should consider including retirement benefits like pension in the scheme as the workers would not have an earning after a certain age.

He added, “Most gig workers live in urban areas where the cost of living is high. Is Rs. 2 lakhs enough for a worker who has to live with a permanent disability after an accident? Considering the current market standards, the government should increase the insurance money.”

Dr. Mokshagundam also pointed out, “The scheme only covers specific causes of death and disability, excluding certain situations like suicides or accidents due to specific circumstances.” She added that the scheme currently excludes ride-hailing drivers and platform based workers beyond delivery services, leaving out a significant portion of the gig workforce.

She also said that the long-term financial sustainability of the scheme is a concern which might require further clarification from the government.

The gig worker and the platform worker have been defined for the purpose of formulating schemes to provide social security benefits under the Code on Social Security 2020. According to the Code, a gig worker is defined as “a person who performs work or participates in a work arrangement and earns from such activities outside of traditional employer-employee relationship.”

Social security schemes can be formulated from the contribution of aggregators and the other sources can include funds from the Central and State Governments. It also mandates that the government set up a toll-free centre or helpline to disseminate information on available social security schemes for the unorganised workers, gig workers and platform workers and to facilitate their enrollment in the schemes.

According to a 2022 study, Data Ownership and Wellbeing of Gig Workers, conducted by IIMA Ventures, a start-up incubator established by Indian Institute of Management- Ahmedabad, out of the 4070 gig workers interviewed, 1913 workers had no form of insurance. The study points out that “Basic workplace requirements like insurance not being offered leave platform workers vulnerable financially.”