Internet banking users of almost every nationalized and private banks are reducing. Banks are burdened with maintenance costs due to fewer users using internet banking facilities. Good effort, but not sure this is anything new.

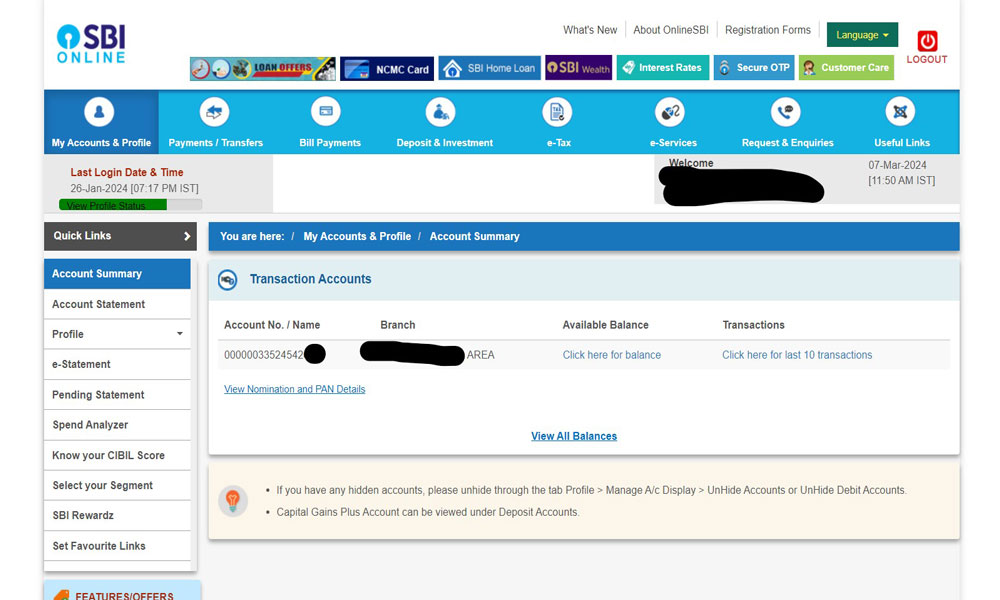

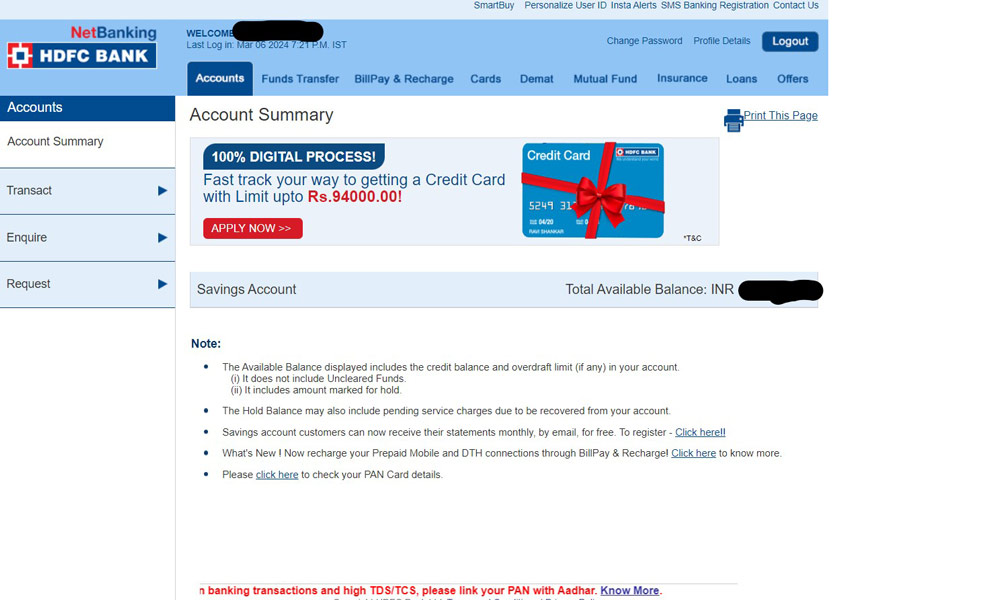

Rohit, is an internet banking or net banking user since 2013. He has a savings bank (SB) account in a big public sector bank (PSB) in the country. He has used IB in the past for big transactions. However, since the last few years he gets the same facilities with better features in mobile banking.

He uses Unified Payments Interface (UPI) for small transactions and petty expenditure He said, “Internet Banking was useful when most transactions were done from desktop. Back then mobile was not so much advanced. Ten years ago the mobile technology was evolving. Most monetary transactions were done either from banks or through features like National Electronic Fund Transfer (NEFT) and Real Time Gross Settlement (RTGS) which was only available in net banking with some restrictions.”

Currently Rohit uses UPI and mobile banking for all sorts of transactions. But he rarely uses net banking. He said that he even forgot the login and transaction passwords of net banking.

UPI was introduced in 2016. It changed the banking style of every user. Money can be credited in real time which was not possible in previous techniques of banking. Since the UPI became more popular, most banks designed their mobile apps with feature of inbuilt net banking.

According to the All India Banks Employees Association (AIBEA), net banking users have reduced by 86 per cent since 2016. In 2017, active IB users were of around 77 per cent of Savings Bank accounts and 80 per cent of Current Accounts (CA). In 2018, net banking customers fell to 60 and 65 percent in SB and CA respectively.

“Since 2019 net banking users have fallen at the rate of 10 to 15 per cent annually. After the pandemic of COVID-19 the usage in IB has fallen at a very steep rate,” AIBEA member said.

According to a study by Indian Institute of Management (IIM) Indore, slowing down of internet banking usage has several reasons. One is its operational and maintenance cost. The other is security.

The study says that it is evident that the incidents of cyber fraud are increasing with net banking users being the prime target. Most net banking users have lost large sums of money to cyber fraud.

A report by Reserve Bank of India (RBI), also suggests that the maintenance and operational cost of net banking facilities is becoming a challenge each day.

However, RBI conducts proper awareness drives for customers while accessing net banking services. But in India most people don’t know how to use computers and internet well. People lack basic knowledge of signing in and out from net banking.

Most banks are now upgrading their system as well as their user interface (UI). They are now trying to bring in single window transactions or apps that can be operable in both desktop and mobiles seamlessly.

Susanta Satpathy, Manager of Indian Bank, Kengeri said, “Net banking is going out of the race slowly. Net banking was once useful when people didn’t have mobile phones and in fact it was the product of the absence of smart phones. But now it’s an era of apps and artificial intelligence (AI). Banks are now focusing on mobile banking apps and have less concern for internet banking.”

He added that having old technologies will only add to the burden of operating costs. Banks are now bringing new technologies for the ease of their customers. Even third party payment gateways like Gpay, Phonepe, Paytm are also offering net banking services in real time which was not present earlier.

Parikshit Govind, retired banker from Indian Bank said that net banking was useful for people who knew how to operate it and had basic knowledge to access it. The most important feature of net banking was of NEFT and RTGS which are now even available in apps like Gpay, Phonepe, Paytm etc.

Govind added that net banking was introduced with the aim of providing self-banking to all account holders. But the present scenario is that every phone in itself is a bank. People can open accounts and even do transactions without having physical SB or CA accounts. Fin tech companies are also now evolving. They provide multiple features like organizing multiple accounts of different banks on a single app and even opening of various banking products like opening of fixed deposits, recurring deposits and much more.

Abhas, software developer in DxMinds, Bengaluru said that the reduction of net banking services is only because of banks end faults. They didn’t upgrade their features including security feature and so people faced a lot of cyber frauds. Banks were reluctant to use latest security features for saving their operating costs.

Abhas added that the increasing popularity of apps is because of the UPI which is working withthe backend support of National Payments Corporation of India (NPCI) and is very easy to use. People are forgetting net banking may be because of its complex UI.