As the popularity of “Buy Now, Pay Later” (BNPL) companies continues to rise, experts are concerned about their sustainability and impact on household debt.

Ajay Kumaran, 21, said that he would never use the BNPL payment option again as he had suffered from a debt cycle before. He had taken loans from two BNPL companies and had to borrow money from his friends to repay them.

“Post- lockdown I used this BNPL option for all e-commerce shopping and at one point I had a debt of about Rs. 1.5 lakhs. I had to sell a few things and my friends helped me pay back the outstanding amount,” Ajay said. He added that the late payment fee contributed to one-third of the total outstanding loan.

With the payment option of BNPL gaining traction over the years, the tendency to get into debt is increasing. Experts also raise alarm about the sustainability of the BNPL companies in the long run.

BNPL is a payment option that allows customers to make payments now and repay them at a later date. They attract little or no interest charges, and unlike a credit card, their approval is easy and it is not mandatory to have a credit history.

The problem of debt

Experts say that online shopping is having a positive impact due to BNPL as there is an increased opportunity to spend by the availability of easy credit. Kaibalyapati Mishra, a research fellow at the Indian Institute for Social and Economic Change, Bengaluru, said, “The recurring nature of spending that the BNPL enables changes the nature of consumer behavior to an extent. Apart from youth, this recurring nature of spending is not widely practiced in the country.” He added that middle-class consumers would mostly be affected if the debt is not appropriately managed, as there is an increasing demand to purchase electronic goods, post-pandemic, through BNPL options.

A 2022 study published in the International Journal of Early Childhood Special Education, proves that there is an overspending tendency and household debt issue when using BNPL options and e-wallets. It shows that around 98 percent of the respondents agreed that there is growth in their household debt due to the usage of the pay-later options.

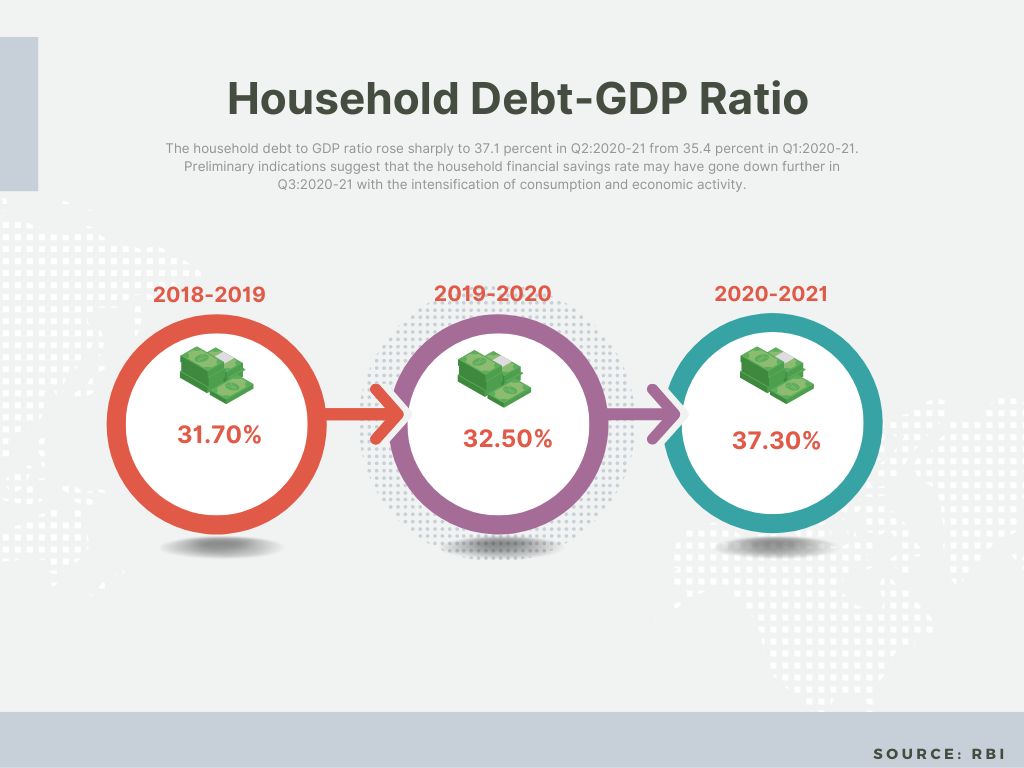

Household debt has increased from 30.10 percent of Gross domestic product (GDP) in 2017 to 37.30 percent in 2021. A report from Business Today shows that BNPL could create a debt culture in the long run.

Bank officials say that the practice of non-payment through BNPL will indirectly affect the borrowing capacity of the potential borrower. Purushothaman, an official from Canara Bank, Cunningham Road, said, “When giving out loans to the borrowers, we check their credit score and look for any non-payment to BNPL companies. When such cases are found, the loan availed will not be sanctioned.” He added that although the BNPL lenders do not charge high-interest rates, in the case of non-payment, the late payment fee is much higher than the interest bank charges.

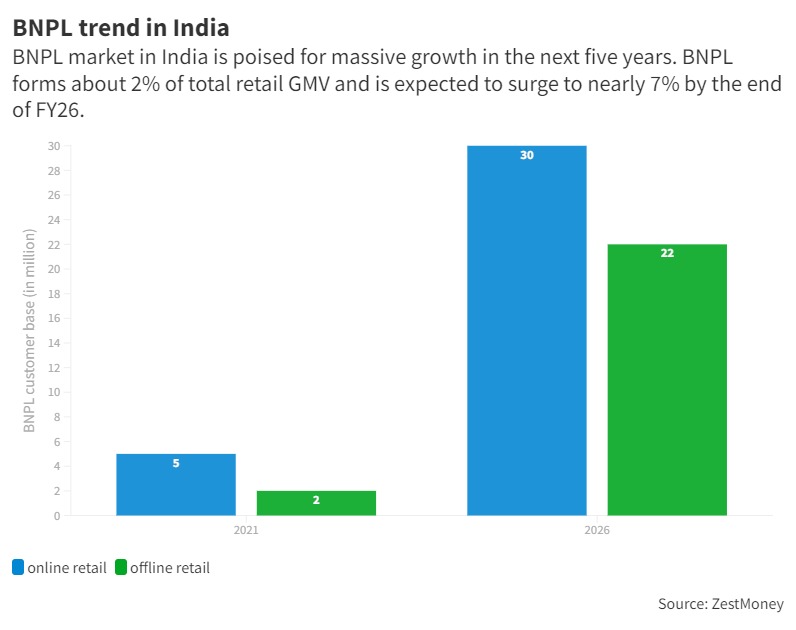

BNPL is the fastest-growing e-commerce online payment method, with 67 percent of the online consumer demand coming from Tier-II and beyond cities in India. According to an annual report by ZestMoney, a BNPL company, there has been an increase in usage of BNPL services by 232 percent by the Generation Z population. A few of the prevailing BNPL companies in India are Simpl, ZestMoney, Amazon Pay later, Paytm Postpaid, etc.

Sustainability

Experts in the BNPL industry doubt the long-term sustainability of the BNPL companies as most of them are not profitable despite their growth rate. Kaushik Saha, a freelance tech expert who has worked in BNPL companies, said, “Most of the BNPL companies are not profitable. The modus operandi of the BNPL companies is such that only the customers and the sellers benefit, and the lending companies suffer as they charge little or no interest, and rely heavily on late payment fees.”

BNPL companies, however, say that late fees are not their only source of income, and they earn through low-cost EMIs, no-cost EMIs, foreclosure charges, etc. Alex Gokavi, Merchant Experience and Support Manager, in a BNPL company, said, “BNPL companies need time to become profitable. The profit margin will be very less for companies which borrow money from lenders who charge high interest. There are other BNPLs who have their own Non-Banking Financial Company (NBFC) licenses and these companies lend on their books, so they have a faster chance of turning profitable.”

Kaushik Saha said that the Non-Performing Assets (NPA) are increasing in the BNPL lenders’ books when compared to personal and other loans given by banks. The financial report of a BNPL start-up ZestMoney shows that the net losses surged by 216 percent in Financial Year (FY) 2022. The reason attributed to the same was the increase in bad loans.

Credit card vs BNPL

In the long run, the credit card issuing banks will be more profitable than the BNPL, even if in the short term these Fintech-backed BNPLs post strong growth, said Kaushik Saha. “Credit card issuing banks are a rivalry to BNPL companies backed by Fintech. The financial backing that the credit card industry gets from banks will be tremendous and will be able to wither any competition,” he added.

Purushothaman said that the personal loan portfolio and the credit card issue will be impacted to a limited extent. “As not all of them can avail personal loans and with the easy credit offered by these Fintech companies, the bank will lose their distribution by a small margin.” A few banks like Axis bank, Kotak Mahindra, etc. have hoped to provide BNPL facilities to their customers. Similarly, other banks and NBFC are lending partners to companies like Flipkart, Amazon, Lazypay, etc.

Alex Gokavi said that people use BNPL as an extra credit line and for the comfort of No cost EMIs. “Credit cards are maxed out for the majority of Indians and they are always in need of additional credit lines.”

The Reserve Bank of India (RBI), in June 2022, came up with the regulation to curb the practice of issuing credit cards by BNPL companies which function under the Prepaid Payment Instruments (PPI). PPIs are the loans given to customers through BNPL companies and the RBI mandates that only banks must issue credit cards.

Alex Gokavi said that the future of BNPL looks very promising considering the youth population in the country who are always in need to do more. BNPL can provide affordability in various segments like E-Commerce, Health, Insurance, education, etc. for these consumers, he added.

The way people use the financial option available at their disposal determines whether a system is good or bad, said Kaibalyapati Mishra. “BNPL has a good impact on the economy as it increases the propensity to consume by giving instant credit. A cause of concern is when the companies try to influence the system by abysmally increasing interest rates and late payment fees,” he said. There will be financial repercussions if the youth are using these options in excess as it is highly possible to change behavior with easy credit options, he added.