Audit professionals are asked to not believe in rumours.

September 23, 2021: The Institute of Chartered Accountants of India (ICAI) President Nihar Jambusariya, in an address to the members of the institute on Sept. 6, 2021, announced that, “The Ministry of Corporate Affairs (MCA) has no plans to abolish audit of small companies.”

This came after a media outlet published a bulletin on its social media handle claiming that the MCA is expected to abolish statutory audit for small companies under the “Companies Act, 2013”. The bulletin cited “ease of doing business” for small enterprises as the primary reason for such an amendment. However, there was no official notification issued by the MCA. Nihar Jambusariya said, “The institute received numerous phone calls and e-mail queries and the news created confusion in the chartered accountant community.”

“The government has been making efforts to reduce the certifications/ reports required by business organizations from CAs and other consultants to improve rankings in the index. It also abolished GST audit last year with similar motives, and the consequences of such a decision will be visible in a few years,” said a council member of the ICAI. He added, “However, the MCA will not abolish audit of small companies, and the videos doing the rounds are based on rumours. If such an amendment is passed, there will be no monitoring of the functioning and financial reporting of small companies.”

Currently, all the companies irrespective of their size and stature are required to get their accounts audited by a CA under the provisions of “Companies Act, 2013”. “I don’t think such amendments are required. Once a company is registered, there are various stakeholders involved and hence, an independent review is required,” said Ansh Manek, Assistant Manager Finance and Accounts at a private company.

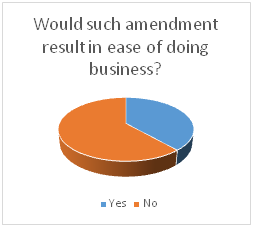

Nikhil Vaid, a CA and partner at multinational accountancy network firm said, “Ease of doing business is not about audits. There are several challenges that businesses face, and audit, if at all is a challenge, would be way low in the pecking order.”

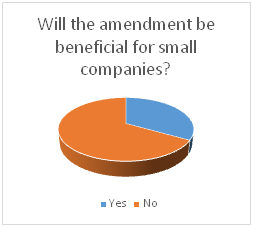

The rumored amendments might be welcomed by executives of small companies as they find audit to be a tedious and complex task. There is also a certain amount of cost involved in getting the audits completed.

Jignesh Pansuria, Director, Solar Pumps Private Limited, whose company would have been affected said, “Auditing is a time and money consuming process. It is complicated and requires a skilled person to conduct auditing as per frequently changing rules and regulations. A small business owner could instead be more focused on the efficiency and profitability with consistency and growth.”

Such a step would adversely impact the revenues of CA firms. Based on a survey, there are several CA firms whose major revenue is derived from audits of small companies. If such audits are abolished, these CA firms might face a serious financial issue. “This amendment would negatively impact small companies, depriving them of strong financial base on which they can grow exponentially,” said Dhruv Shah, Partner at Sorab S. Engineer & Co. (a multi-disciplinary CA firm). He added,“Considering I work in a CA firm this amendment would directly affect the revenues from small companies which we audit. They would consider it as a cost-minimizing measure rather than looking at long term benefits of an audit.”

Advocate and Professor Shreya Madali said, “The amendment (if it does happen) shall definitely create ease of doing business but compliance and financial threats cannot be ignored. It could provide some concessions but a complete strike-off wouldn’t be beneficial.”

The MCA has not commented on the speculations and resisted from replying to e-mails related to the matter. It has also refused to entertain an RTI request stating that a public authority is not required to furnish information that requires ‘drawing of inferences’.

Excellent. Good article.

Thank you! We would love to hear your views around the issue.

Good work Bansal

Thank you!