Users attribute their moving away from dating apps to their preference for making connections in person and the rising scams and bad experiences on these platforms.

It was during her college days that Tina decided to try out one of the popular dating apps. Feeling stressed and wanting some company, she thought it might help. She met different people on the app and even stayed in touch with some of them. But as time passed, she felt that the app wasn’t right for her. Despite not having any bad experiences, she realised that she couldn’t find anything meaningful there, leading to her uninstalling the app. The experiences shared by individuals like Tina, along with trends such as users’ shifting preferences and safety concerns have influenced projections which indicate a decline in the growth of online dating apps.

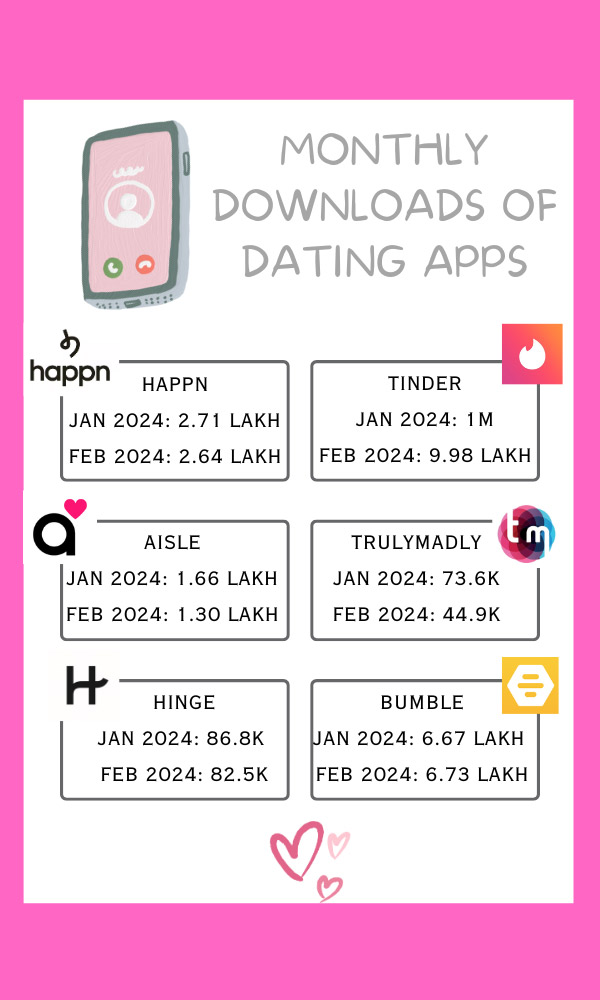

In February 2024, the monthly download statistics for popular dating apps in India for Android devices revealed notable fluctuations compared to January. Happn averaged around 2.31 lakh downloads per month, experiencing a 2.88 percent decline, while Tinder saw an average of 1.1 million downloads per month, marking a 3.90 percent decrease. Aisle recorded an average of 1.97 lakh downloads per month, showing a substantial 21.36 percent decrease, and TrulyMadly maintained an average of approximately 69 thousand downloads per month, experiencing a notable 38.93 percent decrease. Hinge saw around 72 thousand downloads per month, reflecting a 4.93 percent decrease, and Bumble with an average of 7.42 lakh downloads per month, had a slight uptick of 0.93 percent.

This decrease in downloads is also reflected in the projections for the online dating market in India. Reports indicate that the revenue in the online dating market in India is forecasted to reach $69.90 million by 2024. However, between 2024 and 2028, the revenue is expected to exhibit a compound annual growth rate (CAGR) of -1.77 percent, leading to a projected market volume of $65.09 million by 2028. Moreover, user penetration is anticipated to remain stagnant at 1.9 percent during the same period.

The global scenario is not much different. The global dating app industry has seen a steady rise in revenues over the years, reaching a substantial $5.34 billion in 2023, accompanied by a user base of 349 million. Despite this financial growth, global dating app downloads have experienced a decline, dropping to 237.1 million in 2023 from 256.2 million in 2022. This reflects a notable 19.46 percent decrease from the peak of 287.4 million downloads recorded in 2019.

A survey conducted by Axios and Generation Lab in America, the largest market for dating sites, revealed that 79 percent of respondents, particularly college students, said that they did not use dating apps even once a month. They attributed this to their preference for meeting people in person. This inclination towards offline interactions is not only evident among American college students but also extends to their Indian counterparts, who constitute a significant portion of the target audience for such dating applications.

Nasreen, a working professional, shared that neither she nor her friends ever felt the need to download dating apps during their time at college. “Our campus was huge and was filled with students, so we always had someone to chat or hang out with at our favourite spots. Even after we graduated, we stayed connected with the friends we made,” she said. Nasreen said that she thinks it is because they enjoyed meeting people in person and valued those real-life connections that they never bothered to use dating apps, even after college ended.

However, the decline in the growth of online dating apps is not solely due to changing user preferences. Another significant factor contributing to this decline is the fear of encountering scammers and negative experiences on these platforms. This apprehension has driven many people away from using such apps. Sarika shared that during her college days, she and her friends decided to try out dating sites. “Initially, we installed them together as a light-hearted way to pass the time and find some distraction,” she said. However, what began as a casual experiment soon turned into a scary experience. “We realised that individuals only presented good things about themselves on their profiles on these sites and that they were completely different people once you started to interact with them,” she said. Hearing about potential scams and bad experiences of their friends on these platforms made them even more worried, she said. “So, we all made the collective decision to delete the apps, preferring to avoid the risks completely,” she added.

B.S. Vijaya Sai, a hypnotherapist and regression therapist, specialising in marital and relationship counselling, said that the shift from online dating to preferring in-person connections is due to the realisation that not everyone can find what they are looking for online. “People are realising that what they seek—connection and happiness—is often better found in face-to-face interactions. Oxytocin, a hormone released during bonding moments, contributes to this desire for connection. Many initially turned to dating apps in search of this feeling, only to realise it wasn’t always genuine,” he said. In-person meetings, such as those at parties or work, offer a deeper sense of commonality and connection. While online platforms serve as a starting point for exploring relationships, there’s a growing apprehension about the authenticity of profiles and the intentions of online acquaintances, he said. “Some now prefer relationships with childhood friends or familiar faces, valuing the safety and comfort of longstanding connections over those formed online,” he added.

According to reports, Ravi Mittal, founder and CEO of dating app QuackQuack, said, “Expecting quick results from dating apps is like expecting to have a magic wand in your hand that works every time you swipe.” He added that people do not realise that they are setting wrong expectations with their profiles on these platforms which fade out when people realise the reality. “I think with time people will adapt and have realistic expectations from dating apps,” he said.

Snehil Khanor, CEO of TrulyMadly said, “Matchmaking is ultimately a low-retention but early-monetisation play.”

With the decline in the number of downloads and shift in user preferences, reports point out that dating apps have upped their efforts to retain their user base by launching various new features. Niche dating platforms have emerged which are tailored to specific communities or interests. These sites offer users a more personalised experience, facilitating connections with like-minded individuals. Another popular trend is the addition of video-based dating features, allowing users to engage in virtual dates before meeting in person. Additionally, the integration of artificial intelligence and machine learning algorithms into dating platforms has enhanced matching accuracy and provided personalised recommendations, thus improving the overall user experience.

Despite the setbacks, reports indicate that the increasing internet penetration and widespread adoption of smartphones throughout the country, coupled with the growing disposable income and purchasing ability, especially among the middle class, will drive users to invest in dating services and subscriptions. These factors collectively, they state, will ensure that the online dating market in the country will keep going.