Only two states in India allow municipal corporations to borrow through municipal bonds. Experts say that greater awareness is needed for the public to invest in municipal bonds.

Bruhat Bengaluru Mahanagara Palike’s (BBMP) revenue officials say that they are not even thinking of issuing municipal bonds for financing infrastructure projects.

The BBMP presented its budget outlay for 2023-24 where its total revenue for the year is Rs. 11,163.97 crore. Of this, Rs. 7,070.11 crore is from its own revenue receipts and Rs. 4,093.86 crore is from Central and State government grants. Property tax and other cess amounts to 40 percent of the revenue earned and government grants amounts to 33 percent, according to Deccan Herald.

The central government is now pushing for municipal bonds as a way of ensuring municipal corporations (MCs) do not depend wholly on government grants. However, officials from the BBMP revenue department say that the corporation is not looking at municipal bonds as a method of financing at the moment.

“As of now there is no such proposal to issue municipal bonds and frankly no one is even giving a thought about this,” said a BBMP revenue official. He also said that before issuing bonds there needs to be a proper study done to assess how it works in Benagluru.

Finance Minister Nirmala Sitharaman in her 2023 budget speech said that cities will be given incentives to improve their credit worthiness to issue municipal bonds through “property tax governance reforms and ring-fencing user charges on urban infrastructure”.

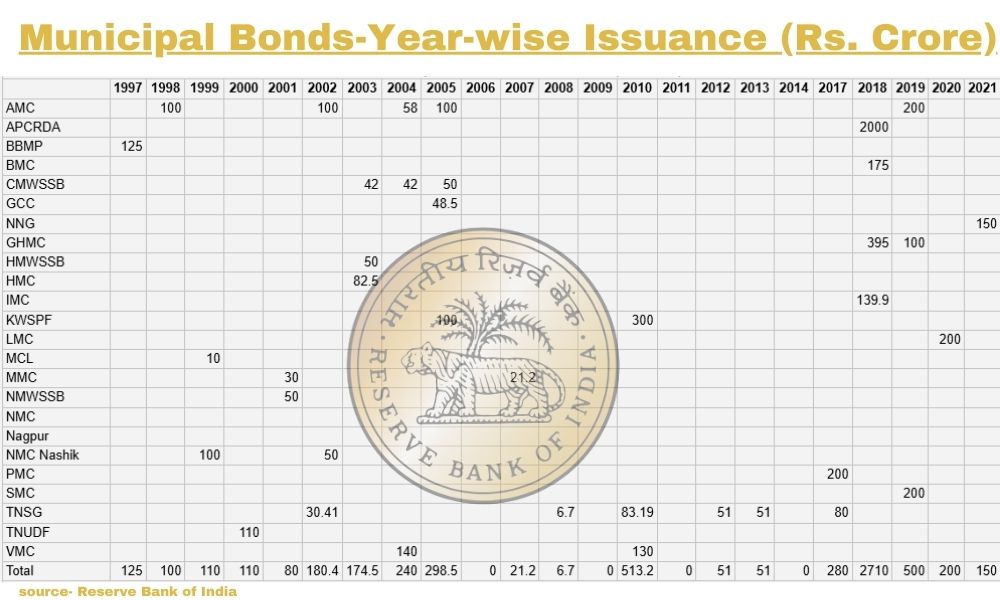

From 1997 to 2005, 20 municipal bonds were issued by civic bodies across India. BBMP was the first civic body to issue a municipal bond for Rs 125 crore in 1997. However, in the last 15 years, from 2006 to 2021, only 18 municipal corporations have issued bonds. A Reserve Bank of India (RBI) report states that issuances of municipal bond came to a sudden halt after 2005 with the launch of Jawaharlal Nehru National Urban Renewal Mission (JNNURM), a central government initiative that granted of Rs. one lakh crore to municipal corporations.

But, the same report shows that in the recent years, there has been an increase in municipal corporations in India issuing bonds. So far, nine civic bodies have raised a total of Rs. 3840 crores from 2017-21.

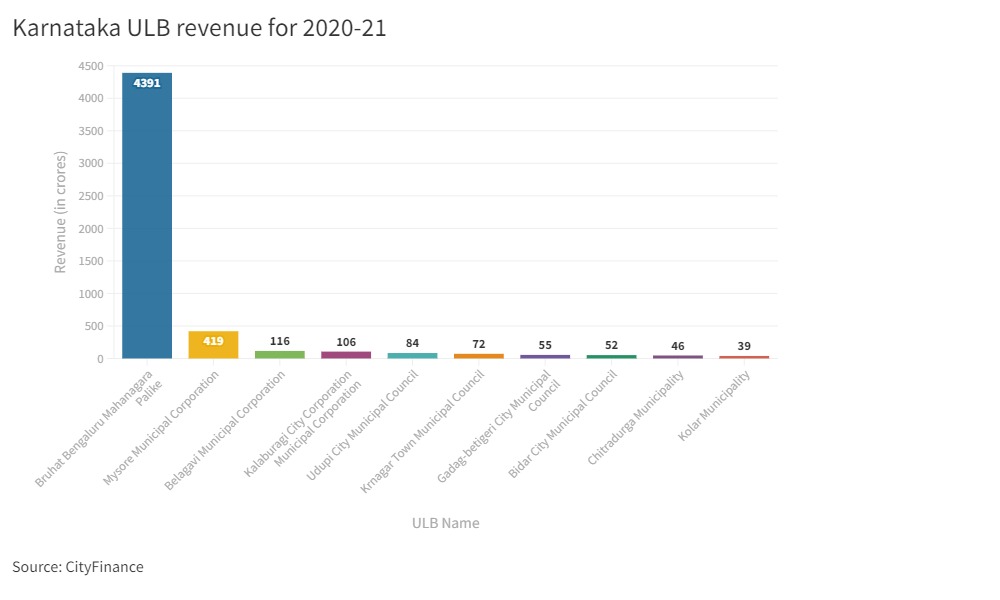

However, raising money through bonds may not be a feasible option for all municipal corporations across India. The RBI report states that, “only large urban local bodies (ULB) with good technical competencies can meet the necessary requirements of bond issuance. For India’s 200 plus municipal corporations and many smaller ULBs, the initial cost of bond issuance can be prohibitively high.”

S. Jaganathan, a charted accountant based in Chennai, said that smaller MCs which do not generate enough income will find it difficult to meet the interest costs of bonds. “The method of raising funds through bonds is not feasible for all corporations. The ones in metro cities are in a better position to raise funds through bonds as they earn through local taxes to meet interest commitments and bond redemption,” he said.

The MCs of Indore, Lucknow, Ghaziabad, Pune and Hyderabad have all raised money through bonds in recent years. However, all of this was done on a private placement basis and was not available for retail investors.

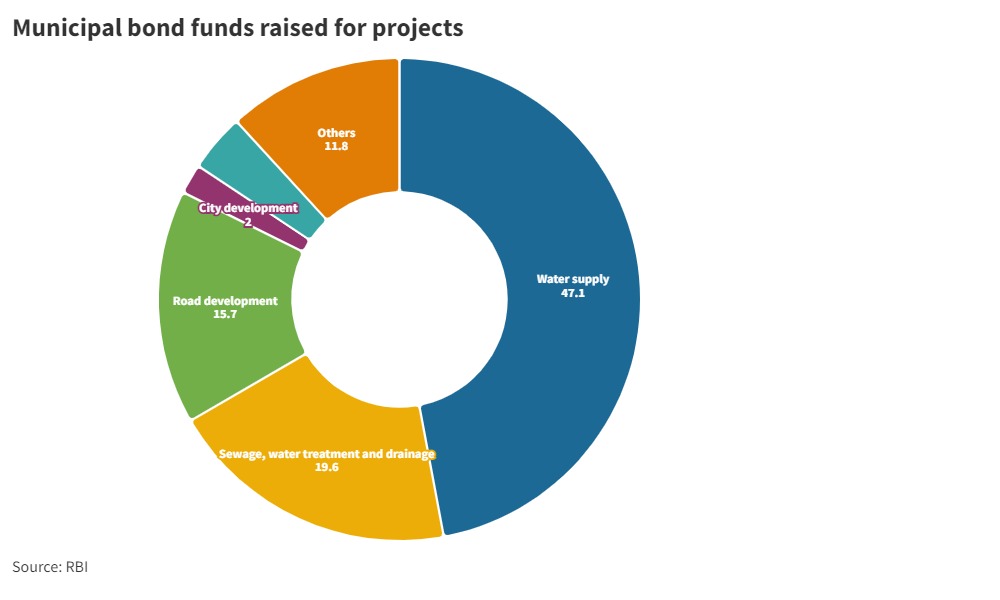

Indore Municipal Corporation became the first civic body to make municipal bonds available to retail investors in February this year. It issued ‘green bonds’ which are used for financing environmentally friendly projects. The issue was oversubscribed 5.19 times and raised Rs 720 crore, according to Economic Times. The bond was issued to raise Rs 244 crore for a 60-megawatt solar power plant project in Samraj and Ashukhedi villages in Khargone district, Madhya Pradesh.

Ramanathan V, a business owner in Chennai said that he only invests in stocks and not bonds. “Generally retail investors have very less knowledge on bonds. All I know is that it is like a fixed deposit,” he said. He said that he was not aware of municipal bonds and that there is very little information on municipal bonds.

In order to make more investors invest in municipal bonds, the central government is issuing credit ratings to civic bodies. The Karnataka Water and Sanitation Pooled Fund (KWSPF) has received a credit rationing of AA+ from Investment Information and Credit Rating Agency of India Limited (ICRA Limited, a credit rating company and BBMP a rating of A- by Brickwork, a credit rating agency. The RBI report states that since the municipal bond market in India is at a nascent stage, credit ratings play an important role in attracting new investors. Also, it said that many MCs have “underutilized potential for bond financing as of the 94 cities that have been assigned credit ratings in 2018, 59 percent received a rating of investment grade or above.” Investment grade rating is AAA to BBB-.

Another hurdle for municipal corporations issuing bonds is that the municipal laws of only two states—Odisha and Bihar—allow MCs to borrow through bond issuances. Municipal laws of other states do not explicitly mention that their MCs can raise funds through issuing bonds. In Karnataka, municipal laws state that MCs can borrow only through loans and debentures. The municipal laws of Tamil Nadu have not mentioned what kinds of borrowings are permitted for MCs, although various civic bodies in Chennai have raised funds through issuing municipal bonds.

In the United States, municipal bonds are exempt from taxes and in India they are taxed like any other listed bonds. Savitha R, former investment advisor at Santander Bank in New Jersey, United States, said that it is very common for people in the US to hold bonds. She said that municipal bonds are not taxed but the capital gains on them are, but if you invest the gains in another bond or stock, it is not taxed.

“Bonds are a good option for low-risk investors, as it has principal guarantee. Bond portfolio is usually less among young people as they have greater potential earning power. Mostly, only older people invest in bonds,” she said. She added that client’s exposure to business knowledge, their economic background also plays a part in their investment choices.

Experts say that for retail investors to invest in municipal bonds in India, they need greater awareness. “It requires wide publicity and advertisement to create awareness among retail investors who lay scattered across the country. Till recently print media was the major mode of communication but it was expensive for the civic bodies, so it was kept away from retail investors. Now with social media, advertisement is comparatively cheaper and can be used to reach investors for fund raising,” said Jaganathan.

Good article! Munibonds are a separate category of investment options but one that is not popular at the moment in India. A timely article on an emerging investment option.

Very interesting article. Details in all aspects of funds or the lack of funds is available for an avid reader.

Lot of diligent research has gone into writing this article! Well done