Street vendors cannot access bank loans despite their inclusion in MSMEs.

Urban street vendors now fall under the ambit of Ministry of Micro, Small, and Medium Enterprise (MSME) but they are unable to get loans because they fail to meet the eligibility criteria.

Vijaylaxmi, a street vendor at Krishna Rajendra (K.R.) Market said that she is unaware of the inclusion of urban street vendors under MSME. She has no documents related to her income, tax returns, securities, etc. but she has both a PAN card and an Aadhar card.

She said that it is difficult for her to get loan from banks because she failed to meet the eligibility criteria—banks doubt her ability to repay on time.

A recent MSME circular announced the inclusion of urban street vendors under it. They can now register on the Udyam registration portal as retail traders. This allows them to take advantage of bank priority sector lending.

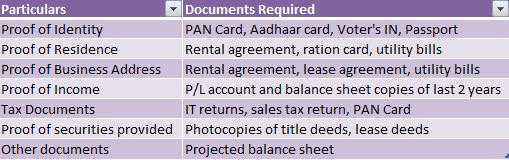

Raghvendra Danti, a banker said that while giving loans to the MSMEs there are certain documents required such as financials, profit and loss statement, internal scoring sheets, tax returns, and documents regarding nature of business. Only after evaluating these documents do the banks lend, he said.

However, the MSME circular does not mention any provision for availability of bank loans to the street vendors. G R Akadas, the director of MSME Development Institute Bangalore, said that it is a policy matter and should be written to the Policy Division of MSME in New Delhi.

Isamail Pasha, a street vendor at K.R. market, said that he does not have many bank transactions as the money gets reused for restocking goods and personal expenses. He added that he struggles with timely repayment of loans so he opts for private lenders rather than banks.

Danti said that while providing them with loans, the banks check their transactions, receipts, license, and repayment history and a nominal balance of approximately Rs. 10,000 to Rs. 20,000. He added that recovering loans from street vendors is a difficult task as they are not very punctual with repayment; they tend to rely on future government schemes to clear their loans out, he added.

Ramesh V.S., a Chartered Accountant (CA), said that this move is intended to include street vendors in the legal lending economy as most street vendors have to deal with loan sharks and succumb to high interest rates. He added that the money which they transact does not pass through bank channels.

However, with the introduction of Unified Payments Interface (UPI), the rate of bank transactions made by these vendors has increased. He said that this has ensured that some of them get loans.