Government bonds with long maturity periods are gaining traction.

Investing in Government security (G-Sec) and long-term bonds may yield profit to the investors due to fewer risks despite the recent hikes in repo rate by the Reserve Bank of India (RBI) to curb inflation.

Gaurav Khemka, deputy vice president at SBI Funds Management Pvt Ltd said that there are four risks when it comes to bonds; namely credit risk, interest risk, liquidity and reimbursement risk. The reason investors are interested in this bond with longer maturity period is because there is less risk of credit and liquidity. “This is the best time to invest in government long-term bonds,” said Khemka.

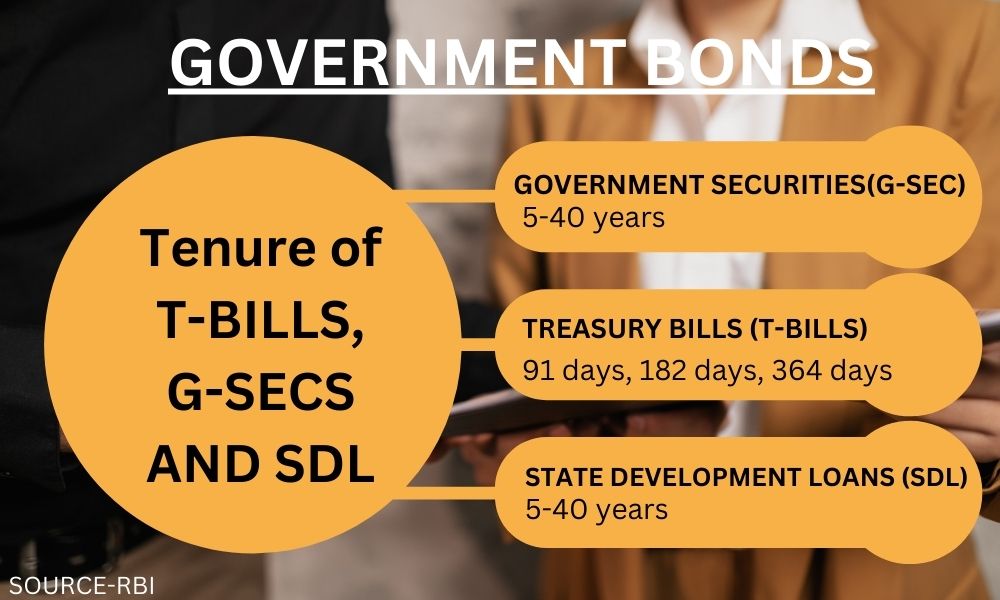

When it comes to G-Sec, it does not have credit risk. “There is always the risk of private companies not performing well and then the investors might lose their money,” said Khemka. But this is not the case for G-sec, as the government will pay the investors back. The maturity period can last up to 40 years.

The RBI has defined, “Government security (G-Sec) means a security created and issued by the government for the purpose of raising a public loan or any other purpose as notified by the government in the official gazette.”

There have been investments worth Rs. 35,000 crores for government long-term bonds all over the country, said Khemkha. There have been investments amounting to Rs. 14,000 crore in SBI alone.”

“I myself have invested in long-term bonds observing the lesser risks involved,” said Khemkha He added that the interest-based risks are a short-term phenomenon. The better guarantees with bonds at 7.5 percent are deemed to be an attractive option for investors.

The four fund houses which have released long-term bonds in India recently are- Aditya Birla Sun Life, Axis, HDFC and SBI, said Money Control in an article.

Raksha \M, Relationship manager at Axis bank said “Since rates have raised, those who want the long-term instruments, they invest in it..””

The decision of the government about the interests is also dependent on global economics and USA’s decision to reduce trade deficit. The reason India has to hike the interest is because India is an importer country. “If India does not follow in increasing rates as well, then they will face issues in importing as this will result in the depreciating value of dollar,” said Khemka.

India imports a total of 563 billion dollars worth commodities from other countries, reported Observatory of Economic Complexity (OEC). It further showed that The top imports of India are Crude Petroleum (93.5 billion dollars), Gold (58.4 billion dollars), Coal Briquettes (28.4 billion dollars), among others. The amount of imports surpassed the amount which is exported from the country, which has resulted in trade deficit.

Dr. Jayesh MP, Assistant Professor in economics at Christ University, Bengaluru said “We have been increasing the interest for some time now.” He added that external factors such as depreciating value of rupee against dollars also plays a role in this.

“The people who are investing in long-term bonds are usually corporate or companies, and not weekly investors who have small amount to invest,” said Khemka.