People are not opting for neo-banking services due to misconceptions and lack of awareness.

Potential neo-banking users prefer not to use the service over the increasing risk of fraudulent transactions and misconceptions about lack of regulation for the industry. Users are hesitant to use the service, even though this means they will never have to visit a bank again.

Kanishkar, 22 is ignorant of the functioning of neo-banking platforms. He decided to opt for the services of traditional banks. He said that he would have chosen neo-bank services if the institutions were regulated. “The risks that come with neo-banking is that they are still not regulated, and the chances of fraud activities are minimal but they exist,” he said.

Neo-banks are digital banks that provide the services of traditional banks but do not have any physical presence. A few functioning neo-banks in India are Jupiter, Instantpay, Niyo, and Razorpay. These neo-banks are partnered with Federal bank, Industrial Credit and Investment Corporation of India (ICICI) bank, Ratnakar Bank Limited (RBL) bank, and State Bank of Mauritius (SBM) bank, respectively.

A Neo-bank user said that his experience with them was good but felt that others’ concerns are valid. Kaushik Saha, a tech expert, had taken a short-term loan and had paid back the same with high interest.

With the increase in data fraud and the prevalence of illegal Chinese loan-distributing apps post-COVID, consumers who do not know the banking system are fearful even about authentic players,said Saha. “Consumers’ skepticism is valid, as they might not even know with whom and how their data is being shared. This is a very serious issue, even though most Indians do not raise a concern,” he said.

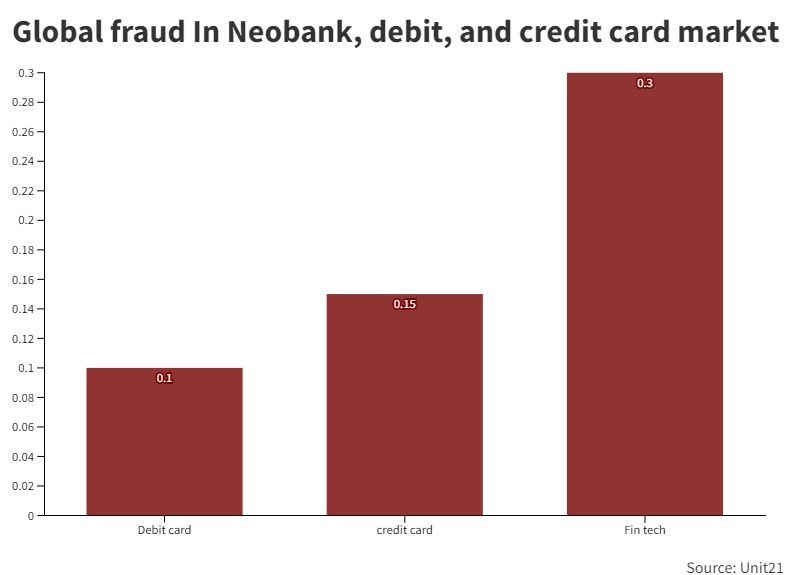

These fears attached with neo-banks go hand-in-hand with the increasing number of frauds in neo-bank transactions, globally. Fraudulent activity in neo-banks is around two to three times more than fraud in credit and debit cards.

In the domestic scenario, studies show that the risk of exposure to cyber fraud, and the risk of failure of transactions remains a concern for the users. The study also highlights that65.5 percent of the respondents of the study were unaware of neo-banking services.

With the increase in illegal lending apps, the government in February 2023 banned around 94 lending apps for being involved in predatory lending, which is lending with high interest rates.

The perspective that neo-banks are completely unregulated, and can compete with traditional banks is wrong, said Meshach Manohar, Chief Business Officer, Accupayd Tech Pvt Ltd, a payment tool company. “In India, neo-banks, per se, will never function as a separate entity and will have to partner with a bank to provide services,” he said. He added that with indirect regulation through traditional banks, neo-banks do come under the RBI framework.

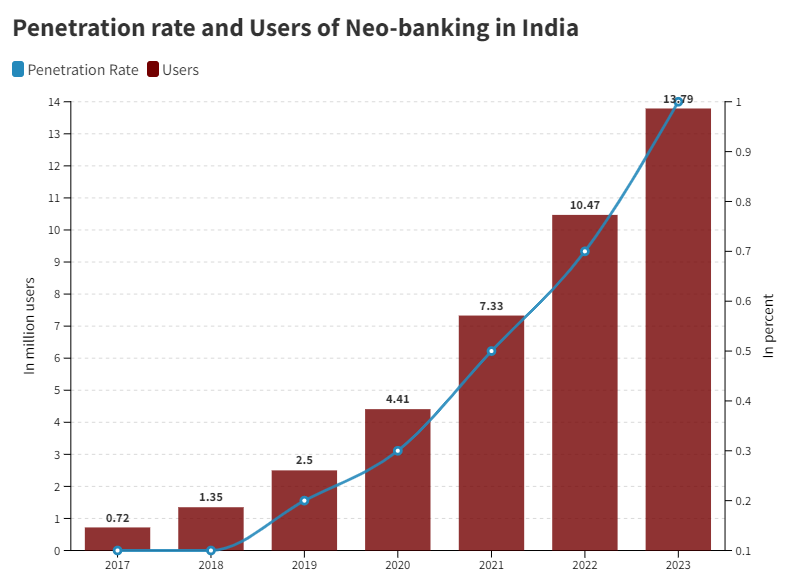

Rahul Bakshi, Founding Member and Group General Counsel of Vance, a global neo-banking platform said that people now understand what digital services are all about and they use such services frequently. “The awareness is very much there. However, as far as the skepticism of users is concerned, it will reduce with the right promotional and marketing activity, digitally or otherwise. It will certainly leave a mark and help them get new users.”

He further stated that neo-banking services will see an exponential rise in demand once applicable regulations are out. “When you have a Regulator’s support, the interest of users to opt for digital services would definitely be seen,” he said.

President and Chief Operating Officer (COO) of Karur Vysya Bank, Natarajan Jagannathan said that the neo-banks in India are in evolving stages. “By focusing on separate segments of the market, the neo-bank’s ability to provide customer service is better than what banks provide. This also enables them to quickly adapt to customers’ behavior and provides a timely feedback system,” he said. He said that the risk for the customers is very minimal as all the data and transactions are carried in the backend, which are the banks. “Neo-banks only operate the front-end operations.”

Natarajan said that there is only a marginal shift of customers from banks to neo-banks. “The particular target audience who wants to experience the new services will opt for those neo-banks and this will not affect banks heavily”, he said.

Bakshi said that RBI will slowly bring the framework to regulate the neo-banking industry. “The industry is fairly new with innovations happening every day. RBI is trying to have all these financial services and payment-related applications within their framework,” he said. By understanding the nuances of the services, RBI will come up with guidelines, and it’s just a matter of time, he said.

Under the umbrella term called neo-bank, there are different focuses. For example, some neo-banks focus on small and medium-sized enterprise (SME) lending, while others may target the youth in India, said Manohar. He also stressed that none of the neo-banks target the economically weaker section as it is not profitable.

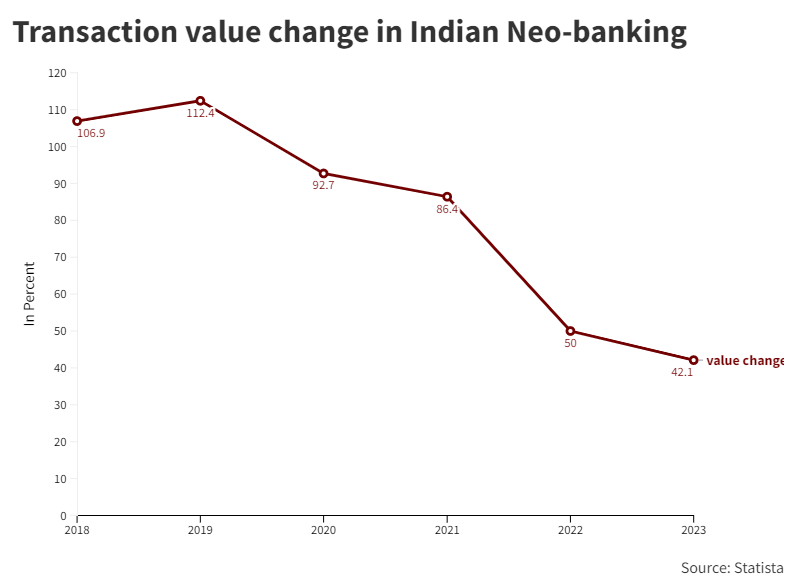

Bengaluru-based neo-bank, Fi, in February 2022 announced that they recorded an average of 15 transactions monthly in the retail segment and about four to five transactions in the industry segment. Manohar said that for a retail-based neo-bank, the average ticket size would be around Rs. 3,000, and for the SME segment it would be around Rs. 15,000 monthly. Manohar added that standalone, neo-banking would find it difficult to make short-term profits, and banks through which they function will have the advantage of expanding cost-free.

Data regarding customers will be shared with the banks, Natarajan said. He added that as per agreements, customers’ data will come from the front end to banks. “We enforce the condition that all the data regarding the customers must come to banks. This is temporary, and going forward, what type of control and security features will be enforced will be a challenge,” he said.

Jupiter, partnered with Federal bank, one of the biggest neo-banks in the country, reported a net loss of Rs. 163 crores in financial year (FY) 22, compared to a net loss of Rs. 14 crores in 2021. But they had an increase in their revenue by 68 percent. Jupiter’s Chief Executive Officer, Jitendra Gupta, in an interview with BQprime, said, “We are way better than last year but profits are far off.” He said that Jupiter will be profitable in four to five years.”

The customers’ choice to opt for a neo-banking service is a tradeoff between risk and convenience, Manohar said. “If someone does not have enough exposure to the banking industry, any small fraudulent incident will keep them away from opting for neo-bank services,” he said.