SEBI can permit private equity companies to sponsor mutual funds as mentioned in the latest notice issued by the regulator.

Mutual funds are apprehensive of Securities and Exchange Board of India’s (SEBI) new decision about making private equity (PE) funds as their sponsors. They believe that it will impact their decision-making powers as private equity funds will hold 40 percent stake in their respective mutual funds.

Vishwa Hegde, Sales Manager at SBI Mutual Fund, said: “It entirely depends on fund houses. Large private equity funds will definitely have an impact on our decision making. For example, if a fund size is Rs. 100 crores and a private equity fund manager has a Rs. 40 crores contribution in it, he will certainly have a significant say in designing portfolios for our customers that we might not want to put in market.”

SEBI in its recent notice proposed allowing private equity funds to sponsor mutual funds to guide them on management, portfolio building for customers, providing the expertise in research and development to understand the Indian stock market more comprehensively. All so that mutual funds companies can come up with more attractive and lucrative investment options. Besides, PEs will also bring in advanced technology.

The proposal comes in the backdrop of Bandhan Bank financial holdings Ltd., Sovereign Wealth Fund GIC and private equity fund ChrysCapital acquiring IDFC Mutual Fund.

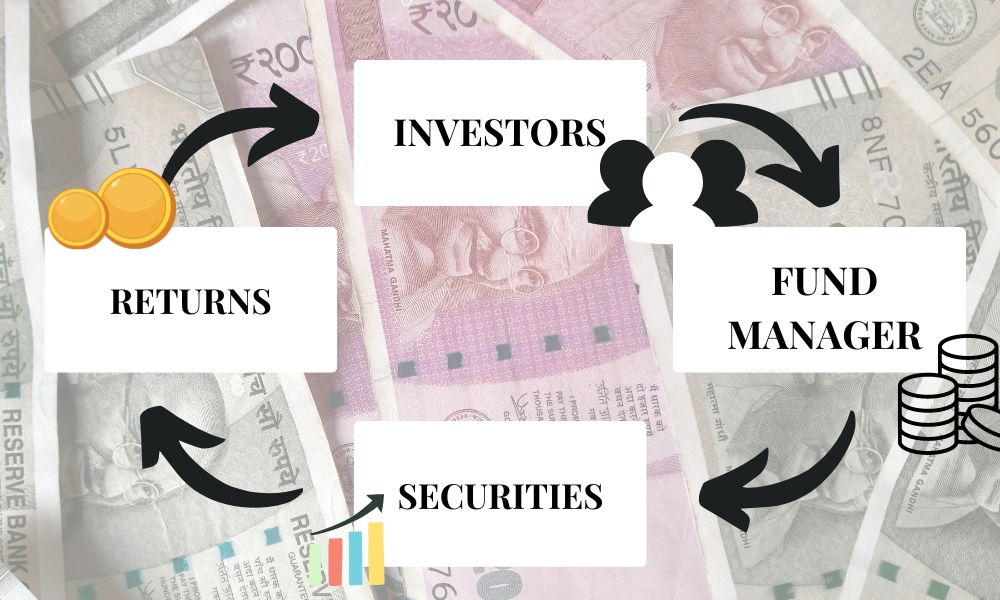

A Private Equity fund is a pooled investment of several investors that make investments out of that fund on behalf of its investors. Unlike mutual funds and hedge funds, private equity funds focus on long-term investment opportunities for a minimum of 10 years. It is an investment strategy to take controlling interest in a business. They engage actively in management of the company in order to increase its value. Due to the nature of private equity funds, mutual funds are in fear of losing their independence.

Hegde pointed out that that SBI has the largest research team that decides on management of funds, debt funds, equity funds and hybrid funds according to the needs of different customers. But, if private equity funds come on board they will decide on building a portfolio with debt, equity or hybrid funds according to their desired end results. This might not be in favour of the customers like high-net worth individuals and retail investors who generally invest in mutual funds. “When players like PEs join us it will change the nature of mutual funds,” he added.

Shobha, Sales Manager at Nippon India Mutual Funds, said: “Management of mutual funds by private equity funds will be new for us. If SEBI finalizes this then we have to dilute the 40 percent stake to the private equity funds companies, and this will have an adverse effect on the independent management of mutual funds. Dilution of 40 percent stake will totally give private equity fund companies an upper hand in decision making.”

She further said that right now the company decides on everything from research on building the best portfolios with a mixture of debt, equity or hybrid funds for the customers to selling these products to the customers. But, if PEs take part in management of the company, they will be the ones to decide on portfolio building. Further, the capital of PEs will be parked in the mutual fund companies for a minimum of five years to provide them a smooth exit. So, to increase the returns on their capital, the PEs will only choose those options that are highly risky but highly profitable at the same time. This might not look attractive to the small-size customers.

SEBI said in its notice that in the last few years, the PEs were indirectly holding stakes in sponsors of mutual funds and sponsors looking for exit would not be able to find good offers other than PEs. Regulation 7 of SEBI (Mutual Funds) Regulations mandates the eligibility criteria for a sponsor of a mutual fund company. The sponsor should have a good track record and a general reputation of fairness and integrity. Also, the sponsor should be in a business for at least five years with a positive net worth throughout these years.

Gavesh Yerasani, Vice President of Ascent Capitals, a private equity firm in Bengaluru said that if SEBI goes forward with the decision, PEs will benefit because it will give more opportunities to grow through more diversified options to invest. However, it could lead to sponsor-management conflict because the motive of private equity firms is different from the motive of a mutual fund company.

Divya Mishra, Professor of Macro Economics, Sophia Girls College, Ajmer said that the mutual fund industry in India stands somewhere around Rs 38.89 lakh crores. This shows it is still at the developing stage. Therefore, a strong sponsor is required to manage newly set-up mutual funds. However, Misha said that SEBI should consider whether stake dilution in the asset management company of a mutual fund company and giving the stake to a private equity fund will serve the unit holders or not. Besides, SEBI should consider the sponsor-management conflict before passing the order.

*Feature Image Credits : SEBI