Workers in the unorganised sector like the ones affiliated with online platforms are at the mercy of their employers.

The unorganised workers do not have a framework to take any legal action if they are treated unfairly by the companies. Most employees resort to strikes in order to get their demands met.

Dathathreya Raju, National President of Delivery Boys Welfare Association (DBWA) said, “There is no way for a worker to physically contact the companies in order to lodge a complaint.” He said their demands are often dismissed or overlooked by their fleet managers.

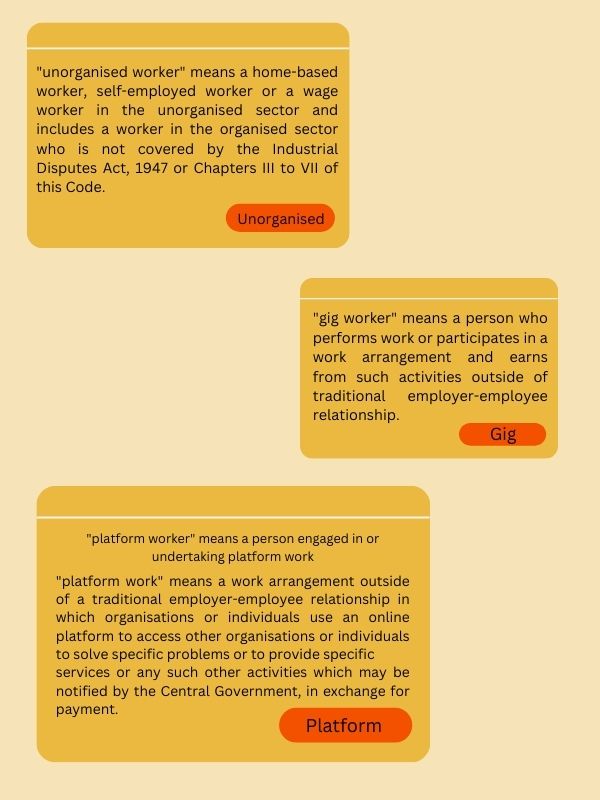

The Code on Social Security, 2020 was created by combining several existing labour protection laws such as The Employees’ State Insurance Act, 1948, The Employee’s Compensation Act, 1923, The Maternity Benefit Act, 1961, The Payment of Gratuity Act, 1972 and so on. These laws seek to improve the working conditions of employees. The Code on Social Security Act defined workers of the unorganized sector engaged in gig and platform work, that do not fall under any formal employer-employee relationship.

The creation of a National Social Security Board was proposed that would look after the unorganized workers. It would recommend and monitor welfare schemes for the unorganized workers, gig workers and platform workers.

Hitesh D Potdar, Researcher and Founder of Labour Inc said, “There are no distinct laws for workers, but the Code on Social Security, 2020 is able to provide them with some social security benefits.” Forbes India released an article that pointed out the problems with the Code. The Code has defined the three workers in such a way that a self-employed worker can fall under gig workers, platform workers as well as unorganized workers. Overall, the experts agreed that the Code seemed to be favouring the companies instead of the workers.

Potdar added that the unorganised workers are deprived of benefits under other acts such as Code on wages 2019, Occupational Safety, Health and Working Conditions 2020, rights under Industrial Relations Code, 2020.

In the 2021-22 Budget, Finance Minister Nirmala Sitharaman announced that social security benefits will be extended to all workers with the implementation of the four labour codes. “The 2021 Budget had mentioned separate schemes for protection and social security that never happened,” said Potdar.

Moreover, Potdar said, “Labour falls under the concurrent list, that is both the Union and the state government have jurisdiction. Therefore, the state government has the power to make amendments.”

Udaykumar Ambonkar, Chairman of Indian Federation of App-based Transport Workers said that there should be some rules imposed on these companies. The workers have a right to social security, pension, economic stability and retirement benefits. “Often, workers are on more than one platform to make the most of their time,” said Ambonkar.

Gajendra, an auto driver in Bengaluru said, “I have all the cab apps on my phone. I have been working with Ola for about eight years now and I recently joined Uber around four years ago.” After the recent dispute between the state government and the apps, the commission has been raised by the companies. For example, completing a ride of Rs. 220 will only get him Rs. 180. The rest of the money goes to the companies. Gajendra continued, “Despite all the shortcomings, I am dependent on these apps. Otherwise, I would not know where the customer is.”

In June 2022, NITI Aayog released a report titled ‘India’s Booming Gig and Platform Economy’ that proposed reforms for the industry. It expects that the number of gig workers will increase from 77 lakhs in 2020-21 to 2.35 crore in 2029-30. It recommended reforms to include health insurance, paid sick leave, retirement plans and such.